Chapter 10 Dynamic regression models

# loading libraries

library(tsibble)

library(tsibbledata)

library(tidyverse)

# to read data

library(rio)

library(ggplot2)

library(fabletools)

library(feasts)

library(fpp3)

library(latex2exp)

library(forecast)10.1 Regression with ARIMA errors using fable

To fit a regression model with ARIMA errors, the pdq() specifies the order of the ARIMA errors model.

If differencing is specifies, then the differencing is applied to all variables in the regression model. Use

ARIMA(y ~ x + pdq(1,1,0))to apply dirfferencing to all variables.

The constant disappears due to the differencing. Add 1 to include the constant.

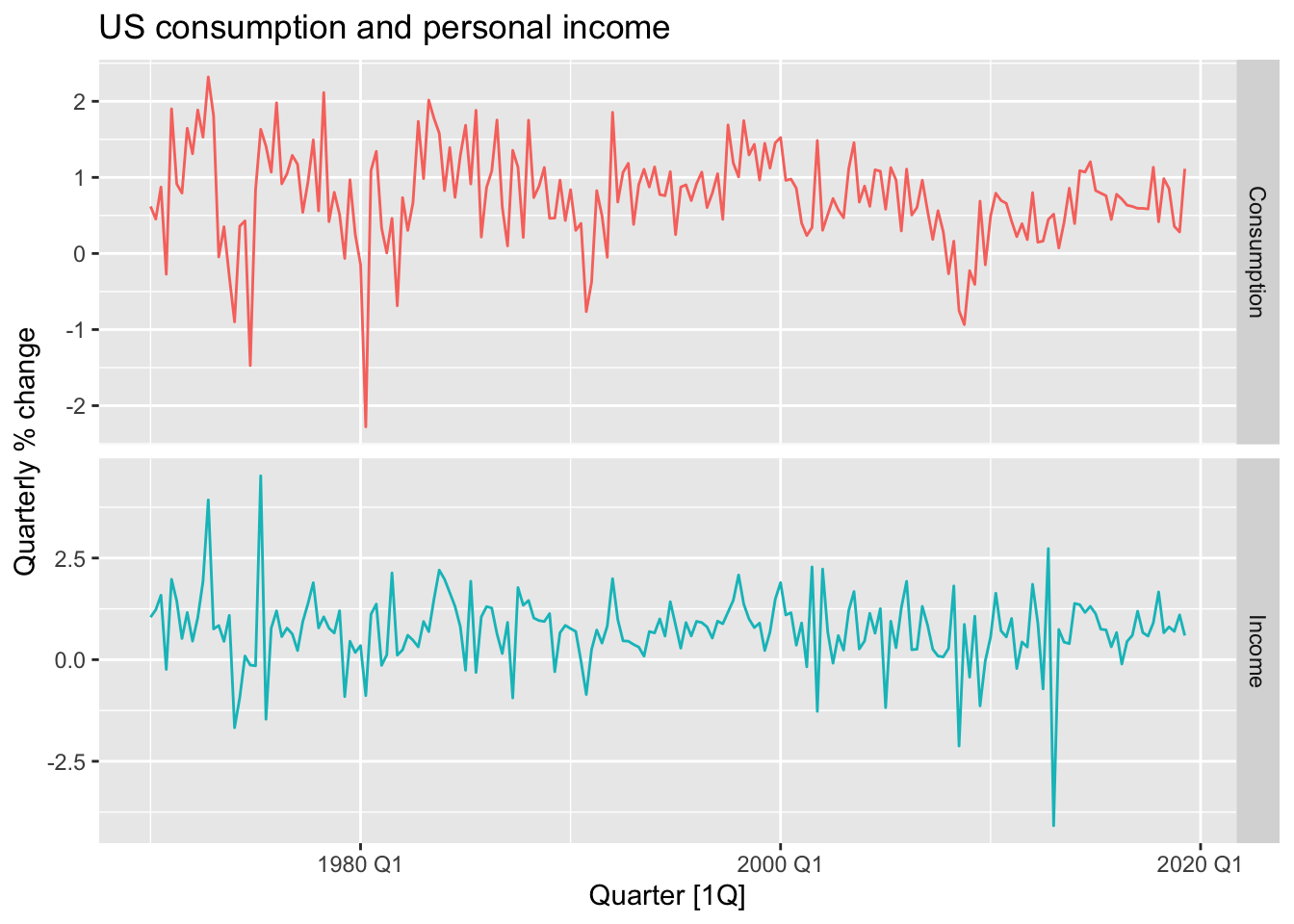

10.1.1 Example: US Personal Consumption and Income

us_change |>

pivot_longer(c(Consumption, Income),

names_to = 'var', values_to = 'value') |>

autoplot(value) +

facet_grid(var ~ ., scales = 'free_y') +

labs(title = "US consumption and personal income",

y = "Quarterly % change") +

theme(legend.position ='none')

## Series: Consumption

## Model: LM w/ ARIMA(1,0,2) errors

##

## Coefficients:

## ar1 ma1 ma2 Income intercept

## 0.7070 -0.6172 0.2066 0.1976 0.5949

## s.e. 0.1068 0.1218 0.0741 0.0462 0.0850

##

## sigma^2 estimated as 0.3113: log likelihood=-163.04

## AIC=338.07 AICc=338.51 BIC=357.8bind_rows(

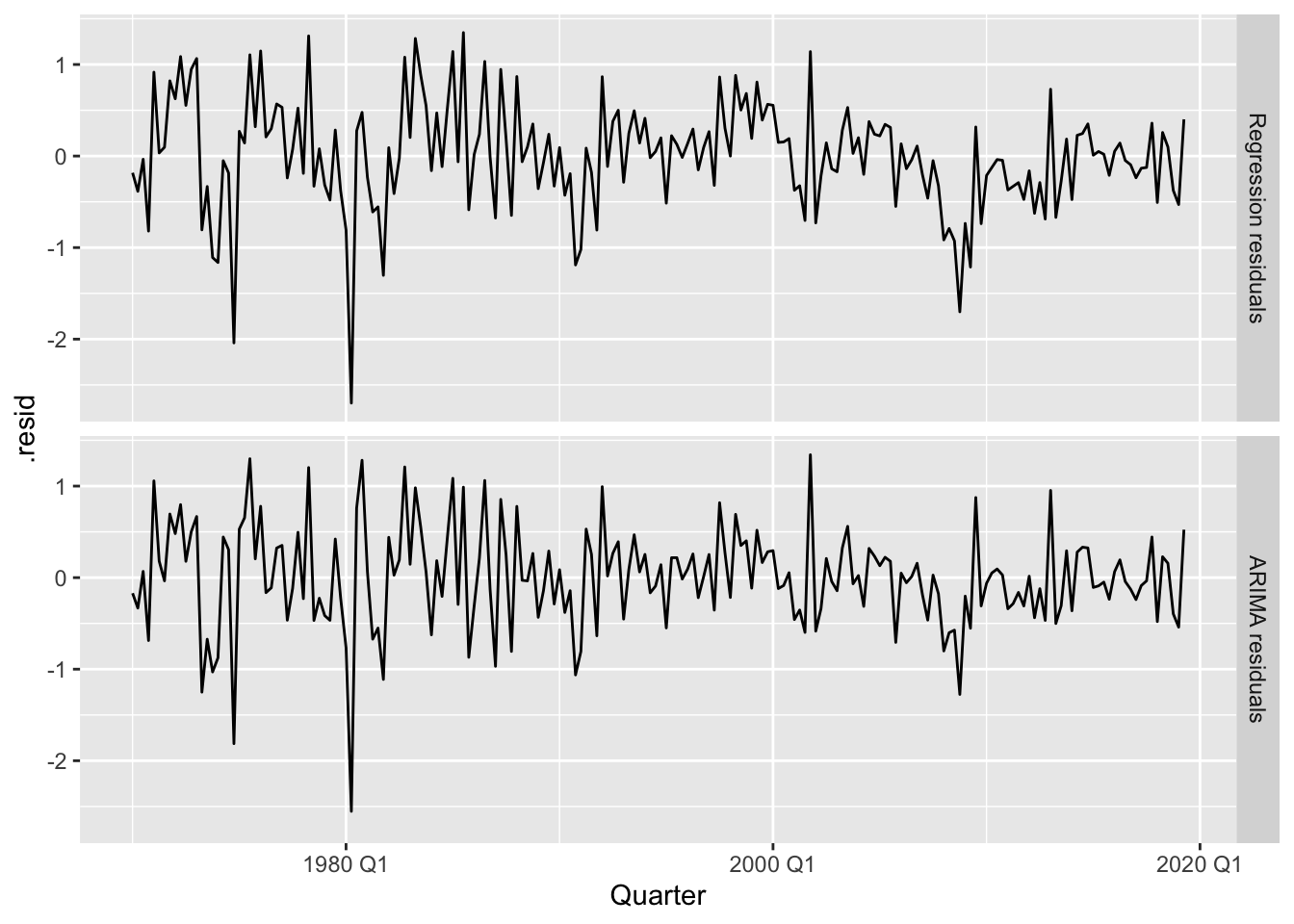

`Regression residuals` =

as_tibble(residuals(fit, type = "regression")),

`ARIMA residuals` =

as_tibble(residuals(fit, type = "innovation")),

.id = "type"

) |>

mutate(

type = factor(type, levels=c(

"Regression residuals", "ARIMA residuals"))

) |>

ggplot(aes(x = Quarter, y = .resid)) +

geom_line() +

facet_grid(vars(type))

## # A tibble: 1 × 3

## .model lb_stat lb_pvalue

## <chr> <dbl> <dbl>

## 1 ARIMA(Consumption ~ Income) 5.21 0.391We cannot reject \(H_0\), so there is no autocorrelation in the residuals.

10.2 Forecasting

To forecast using a regression model with ARIMA errors, we need to forecast the regression part of the model and the ARIMA part of the model, and combine the results. When the predictors are themselves unknown, we must either model them separately, or use assumed future values for each predictor.

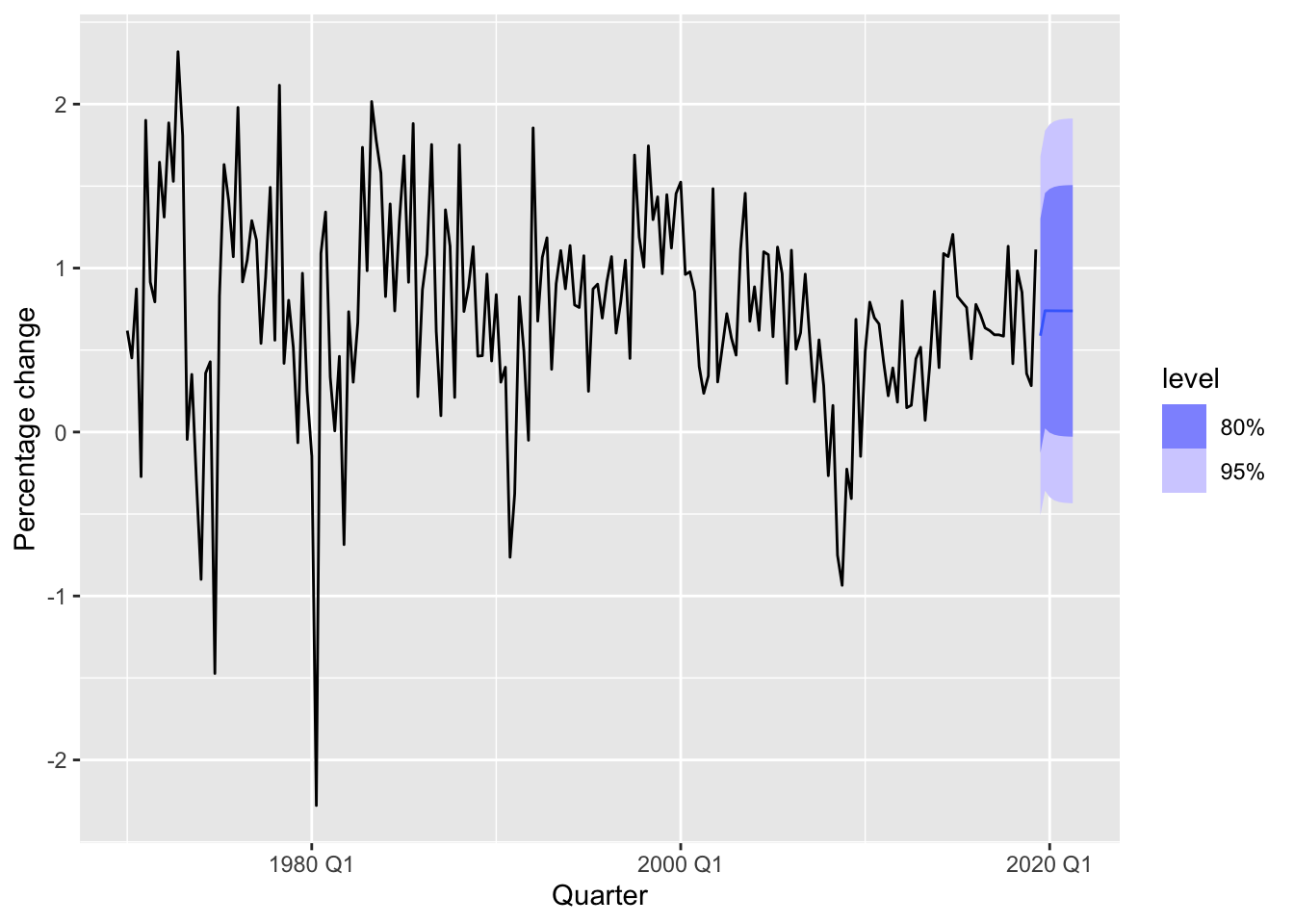

10.2.1 Example: US Personal Consumption and Income

us_change_future <- new_data(us_change, 8) |>

mutate(Income = mean(us_change$Income))

fit |>

forecast(new_data = us_change_future) |>

autoplot(us_change) +

labs(y = "Percentage change")

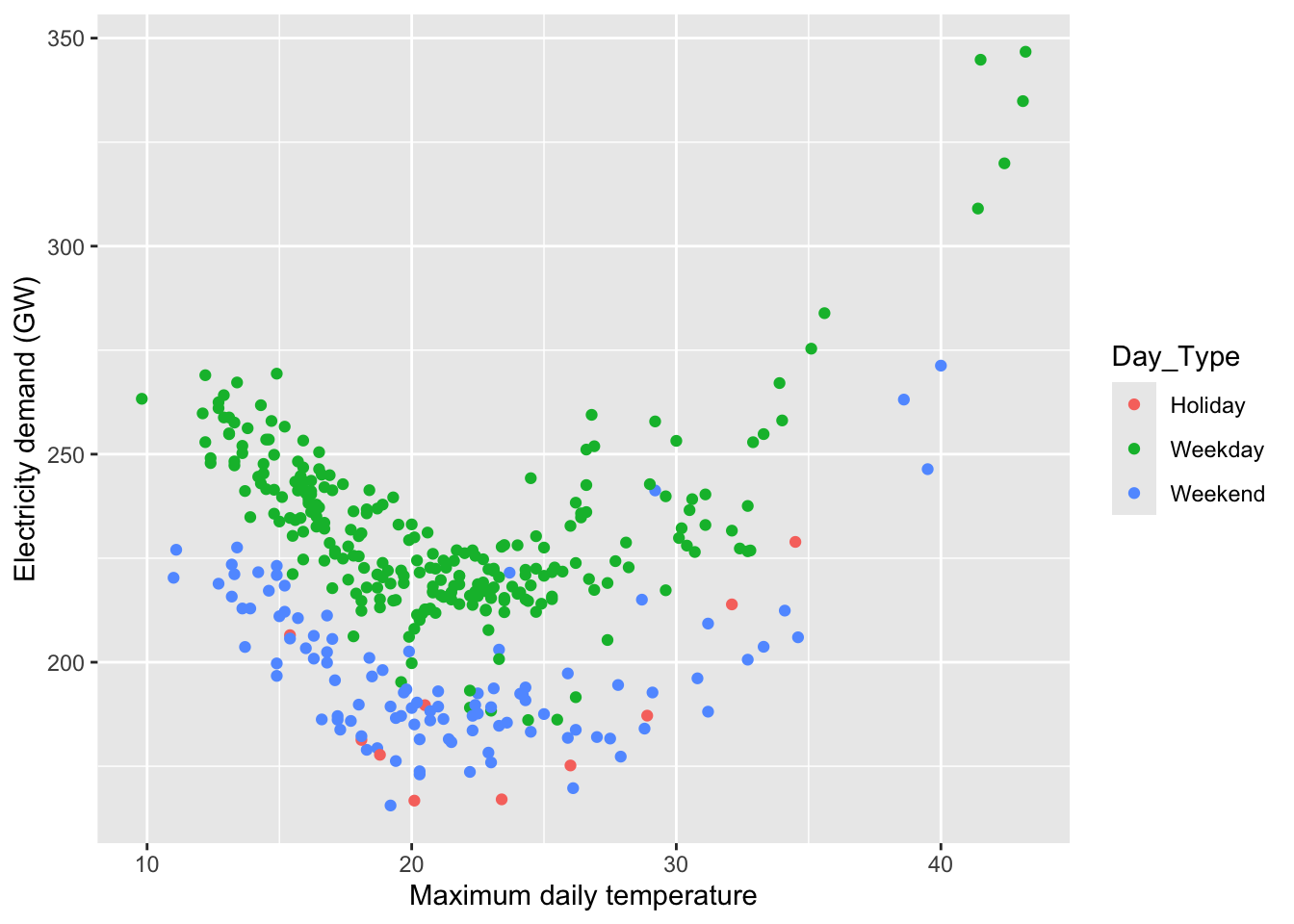

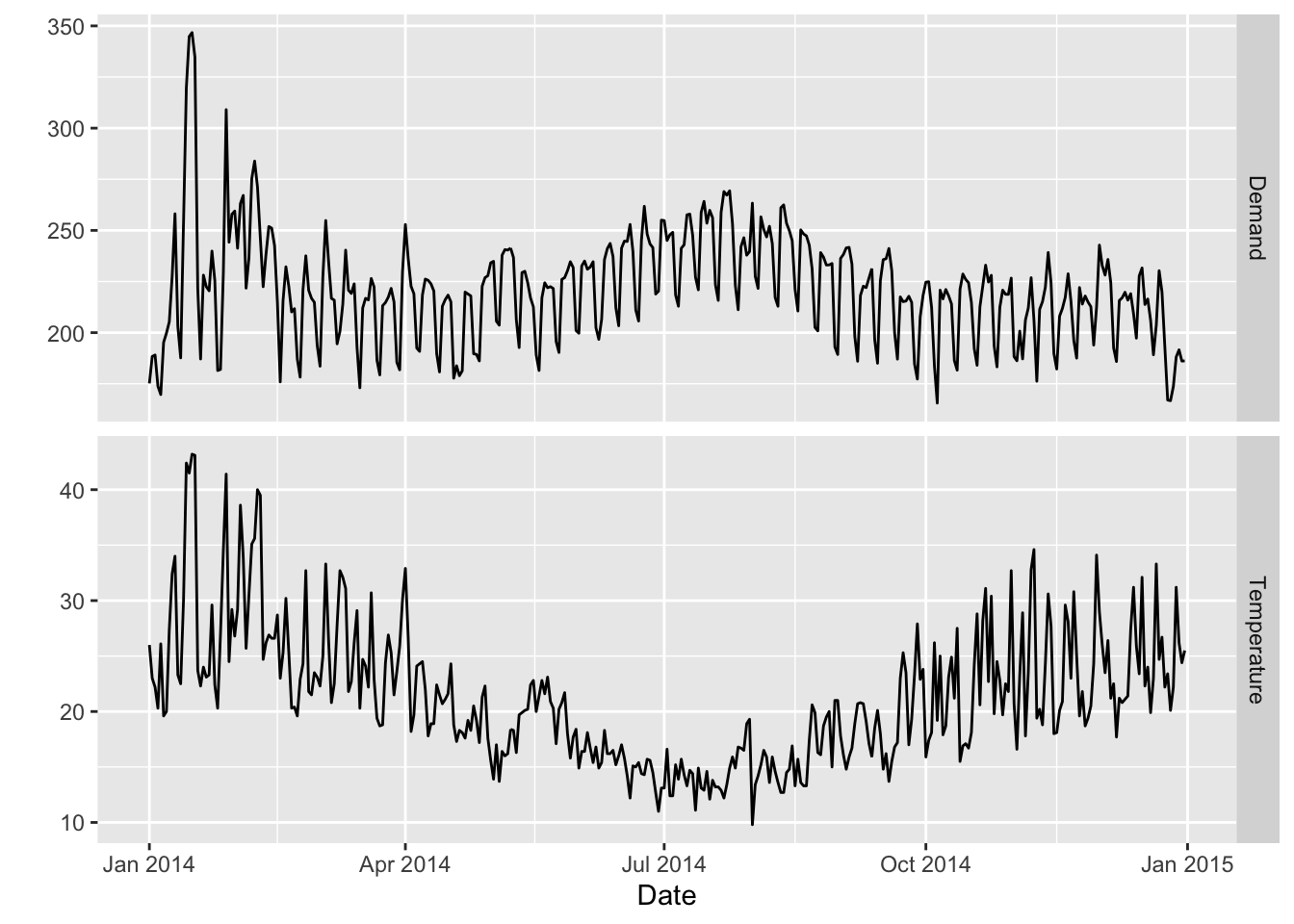

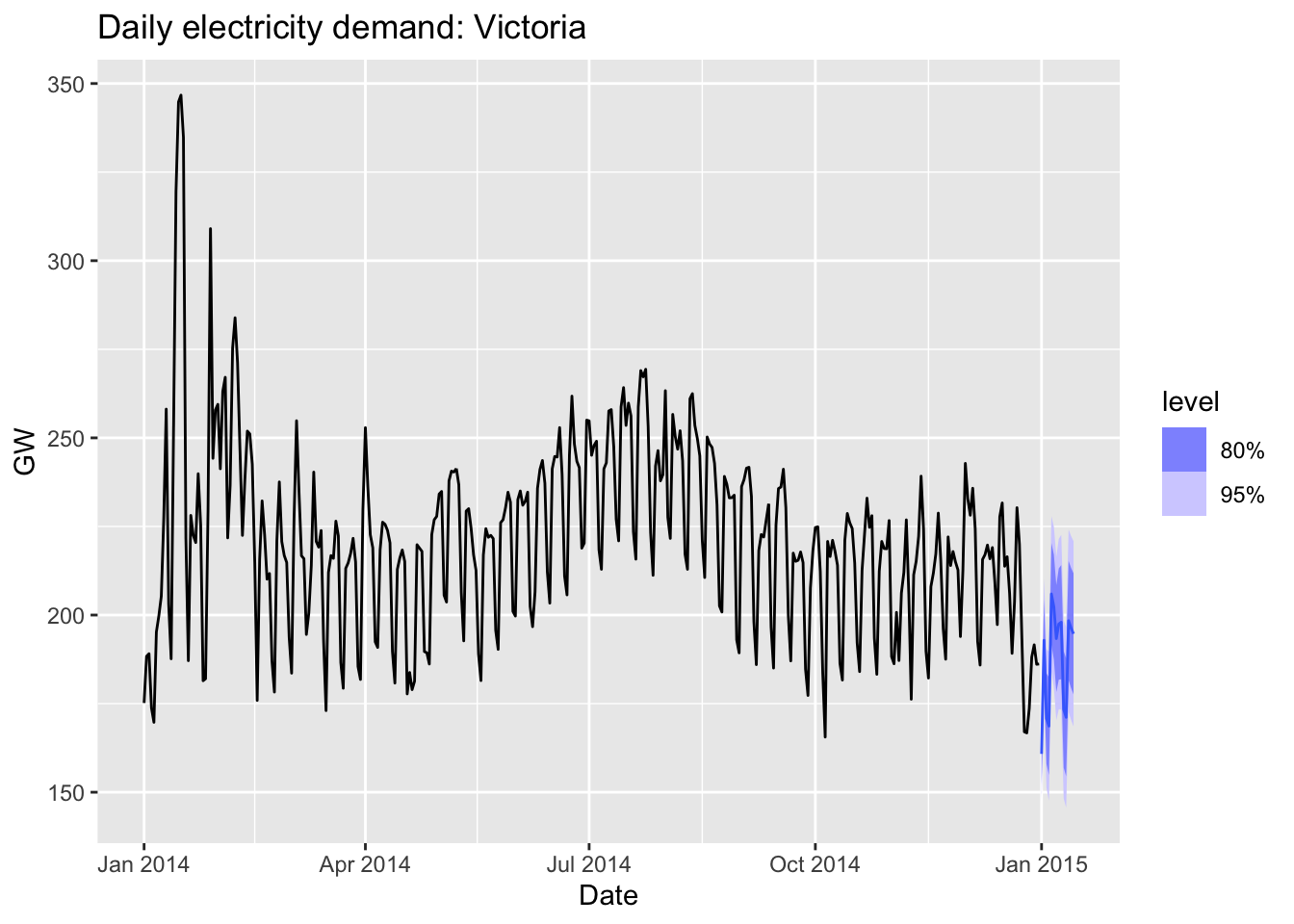

10.2.2 Example: Forecasting electricity demand

vic_elec_daily <- vic_elec |>

filter(year(Time) == 2014) |>

index_by(Date = date(Time)) |>

summarise(

Demand = sum(Demand) / 1e3,

Temperature = max(Temperature),

Holiday = any(Holiday)

) |>

mutate(Day_Type = case_when(

Holiday ~ "Holiday",

wday(Date) %in% 2:6 ~ "Weekday",

TRUE ~ "Weekend"

))

vic_elec_daily |>

ggplot(aes(x = Temperature, y = Demand, colour = Day_Type)) +

geom_point() +

labs(y = "Electricity demand (GW)",

x = "Maximum daily temperature")

vic_elec_daily |>

pivot_longer(c(Demand, Temperature)) |>

ggplot(aes(x = Date, y = value)) +

geom_line() +

facet_grid(name ~ ., scales = "free_y") + ylab("")

fit <- vic_elec_daily |>

model(ARIMA(Demand ~ Temperature + I(Temperature^2) +

(Day_Type == "Weekday")))

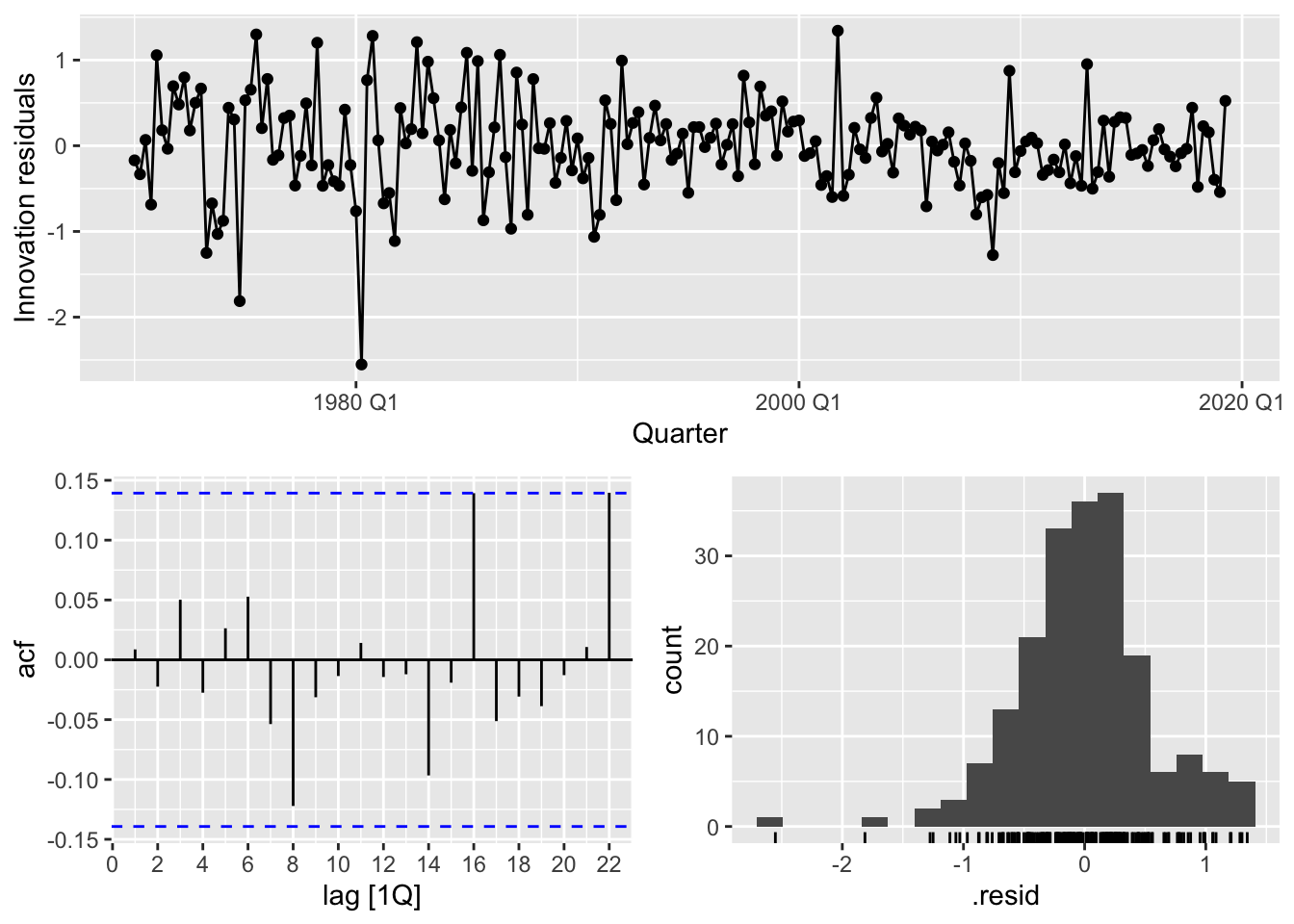

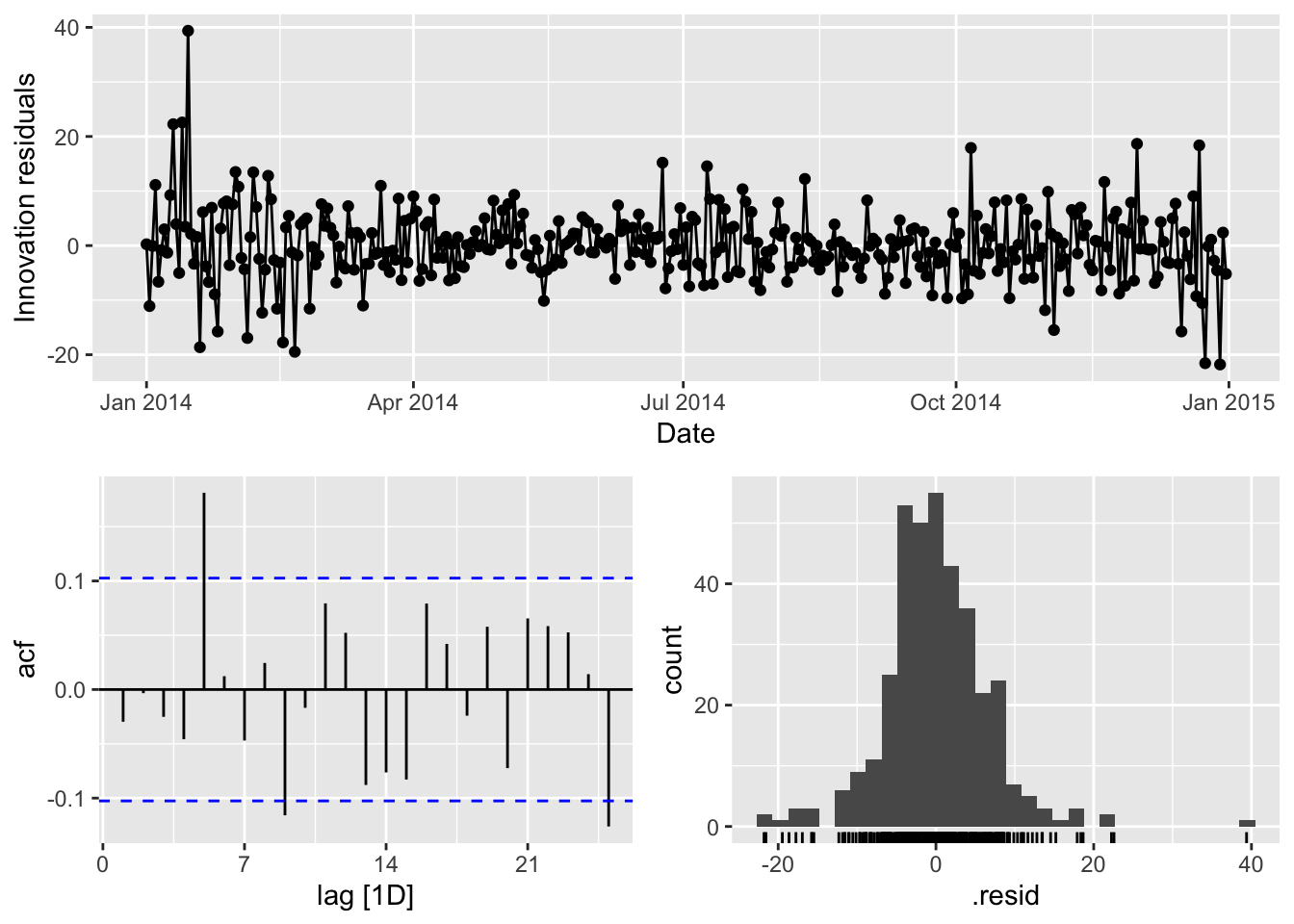

fit |> gg_tsresiduals()

# dof = p + q + P + Q = 2 + 2 + 2 + 0

augment(fit) |>

features(.innov, ljung_box, dof = 6, lag = 14)## # A tibble: 1 × 3

## .model lb_stat lb_pvalue

## <chr> <dbl> <dbl>

## 1 "ARIMA(Demand ~ Temperature + I(Temperature^2) + (Day_Type == \n \"Weekday\"))" 28.4 0.000404vic_elec_future <- new_data(vic_elec_daily, 14) |>

mutate(

Temperature = 26,

Holiday = c(TRUE, rep(FALSE, 13)),

Day_Type = case_when(

Holiday ~ "Holiday",

wday(Date) %in% 2:6 ~ "Weekday",

TRUE ~ "Weekend"

)

)

forecast(fit, vic_elec_future) |>

autoplot(vic_elec_daily) +

labs(title="Daily electricity demand: Victoria",

y="GW")

10.3 Stochastic and deterministic trends

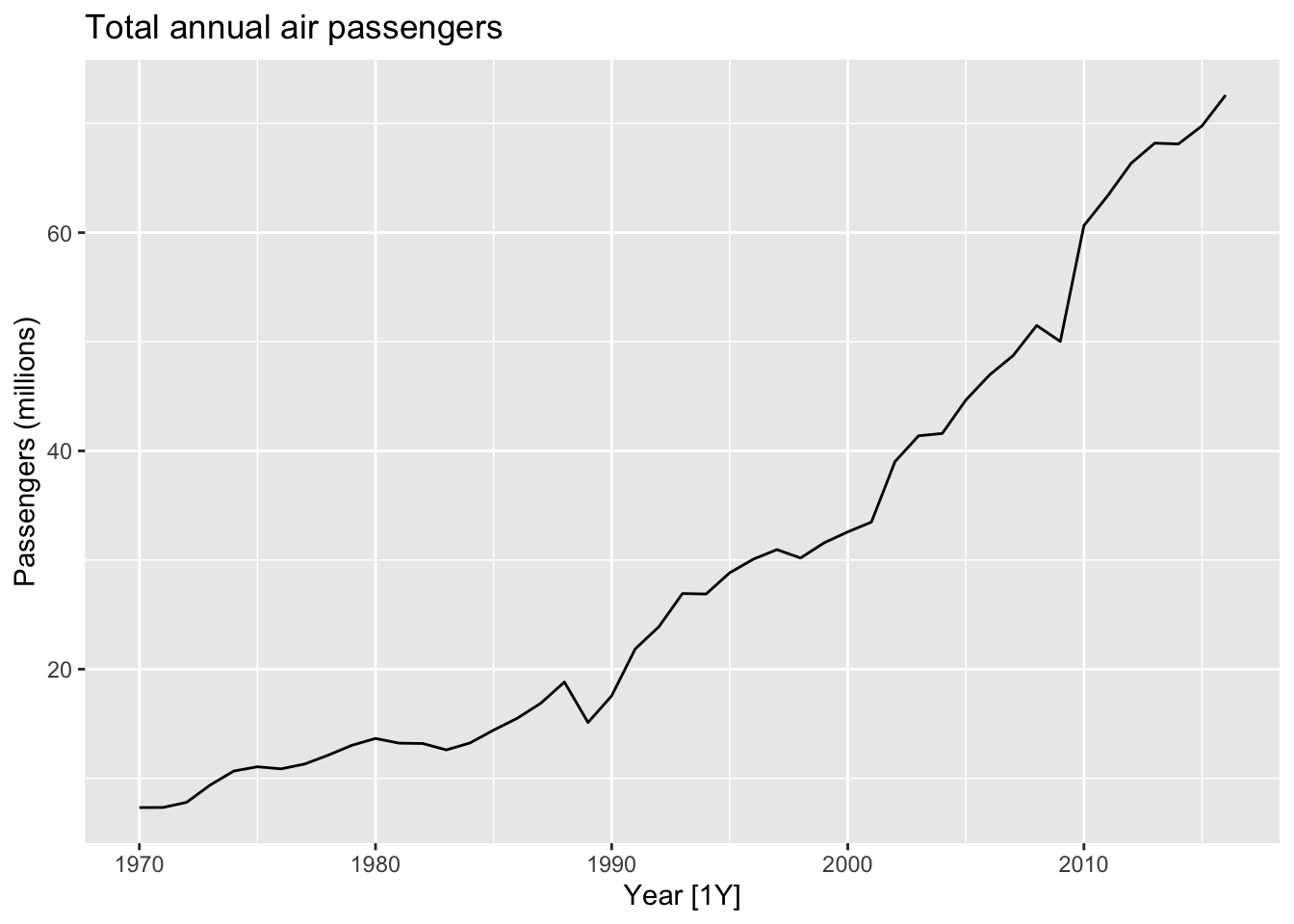

10.3.1 Example: Air transport passengers Australia

aus_airpassengers |>

autoplot(Passengers) +

labs(y = 'Passengers (millions)',

title = 'Total annual air passengers')

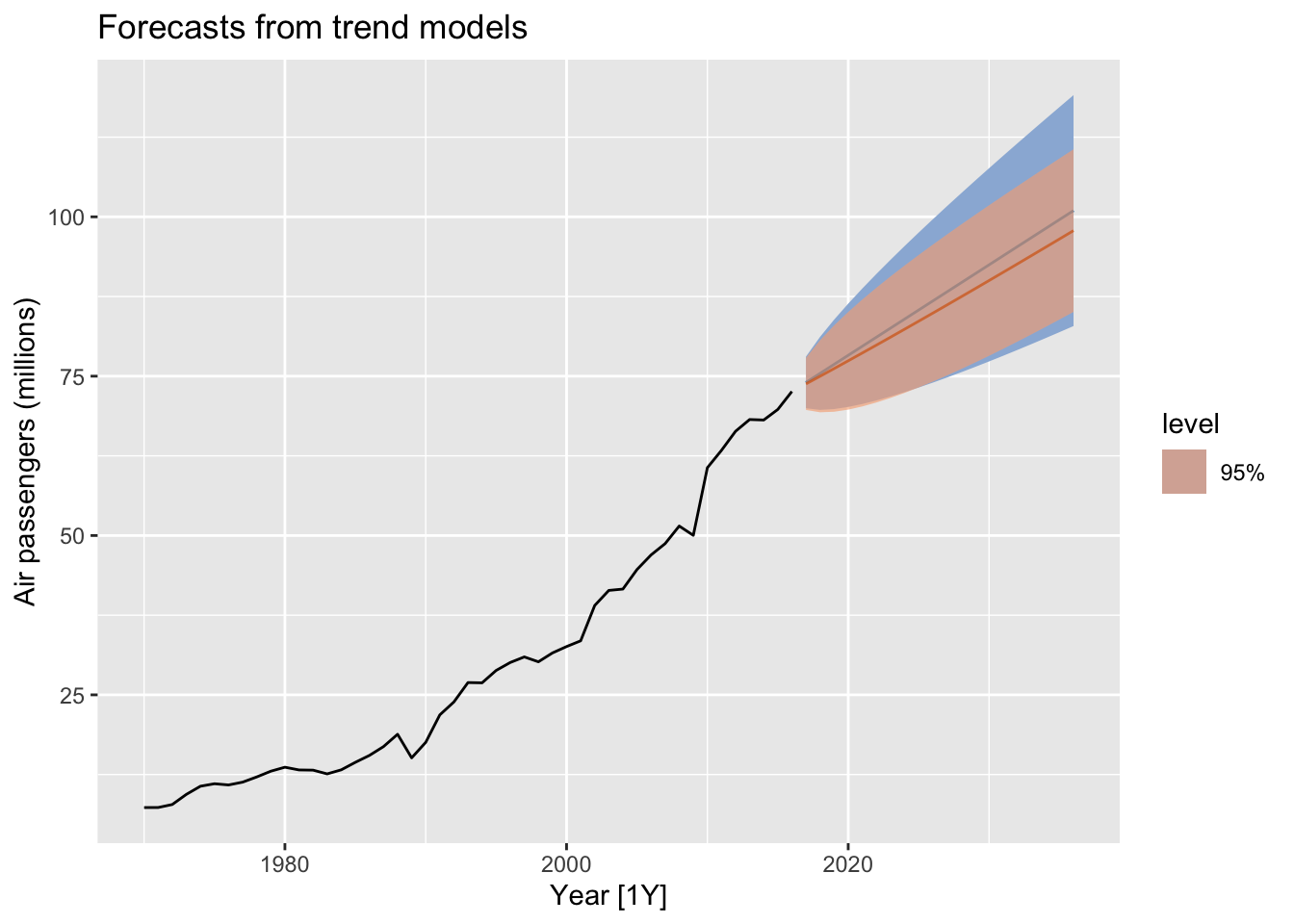

- The deterministic trend model

fit_deterministic <- aus_airpassengers |>

model(deterministic = ARIMA(Passengers ~ 1 + trend() + pdq(d = 0)))

fit_deterministic |> report()## Series: Passengers

## Model: LM w/ ARIMA(1,0,0) errors

##

## Coefficients:

## ar1 trend() intercept

## 0.9564 1.4151 0.9014

## s.e. 0.0362 0.1972 7.0751

##

## sigma^2 estimated as 4.343: log likelihood=-100.88

## AIC=209.77 AICc=210.72 BIC=217.17- The stochastic trend model

fit_stochastic <- aus_airpassengers |>

model(stochastic = ARIMA(Passengers ~ pdq(d = 1)))

fit_stochastic |> report()## Series: Passengers

## Model: ARIMA(0,1,0) w/ drift

##

## Coefficients:

## constant

## 1.4191

## s.e. 0.3014

##

## sigma^2 estimated as 4.271: log likelihood=-98.16

## AIC=200.31 AICc=200.59 BIC=203.97aus_airpassengers |>

autoplot(Passengers) +

autolayer(fit_stochastic |> forecast(h = 20),

colour = "#0072B2", level = 95) +

autolayer(fit_deterministic |> forecast(h = 20),

colour = "#D55E00", alpha = 0.65, level = 95) +

labs(y = "Air passengers (millions)",

title = "Forecasts from trend models")## Scale for fill_ramp is already present.

## Adding another scale for fill_ramp, which will replace the existing scale.

- The slope of the deterministic trend is not going to change over time.

- It is safer to forecast with stochastic trends, especially for longer forecast horizons, as the prediction intervals allow for greater uncertainty in future growth.

10.4 Dynamic harmonic regression

The dynamic regression with Fourier terms is often better for long seasonal periods.

The ARIMA() function is allow a seasonal period up to \(m=350\).

The harmonic regression allows:

- any length seasonality

- Fourier terms of different frequencies can be used for data with more than one seasonal period

- \(K\) param controls the smoothness of the seasonal pattern. It is the number of Fourier sin and cos pairs. The smaller \(K\) is, the smoother the seasonal pattern is.

The seasonality has to have fixed pattern over time.

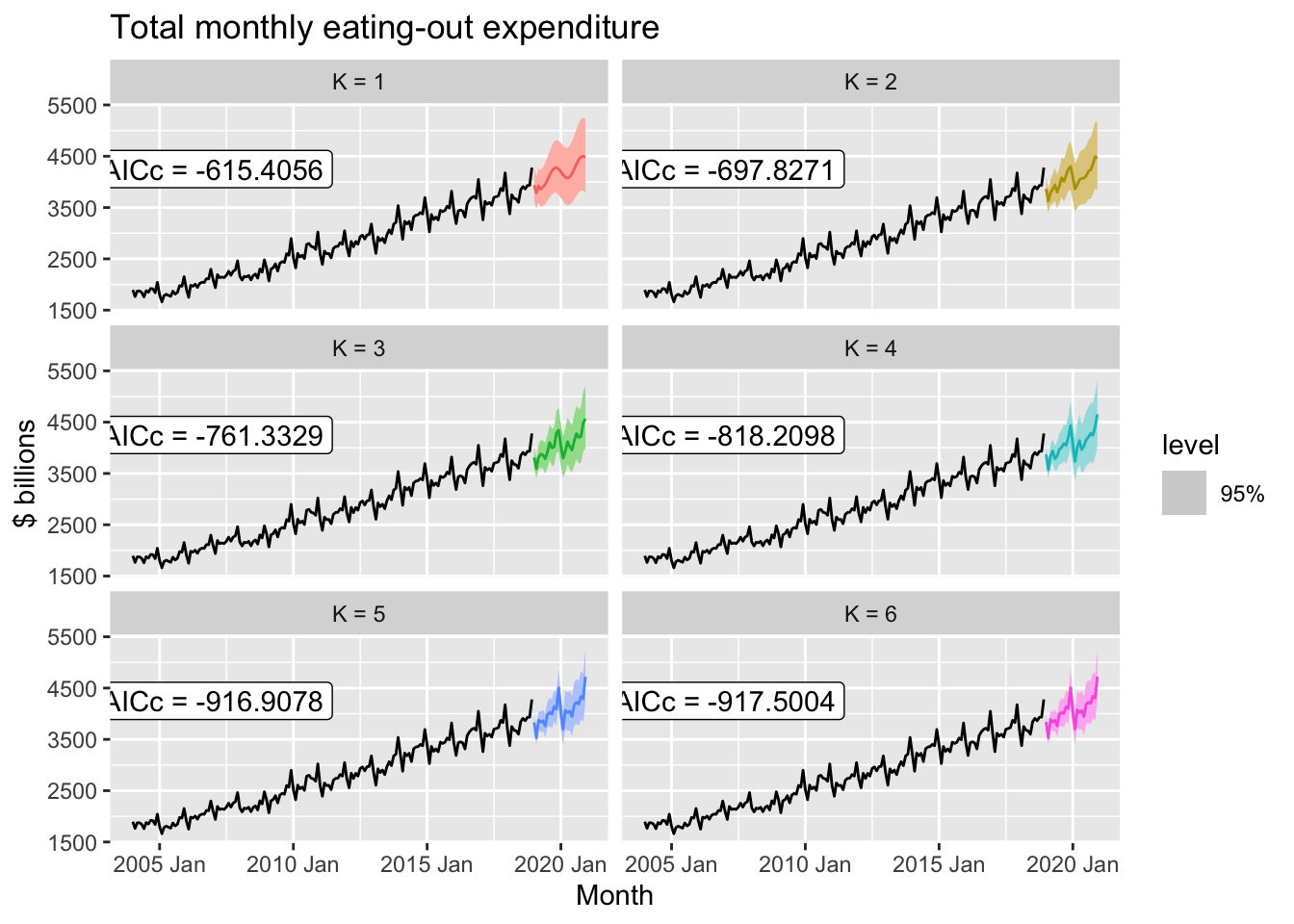

10.5 Example: Australian eating out expenditure

aus_cafe <- aus_retail |>

filter(

Industry == "Cafes, restaurants and takeaway food services",

year(Month) %in% 2004:2018

) |>

summarise(Turnover = sum(Turnover))

fit <- model(aus_cafe,

`K = 1` = ARIMA(log(Turnover) ~ fourier(K=1) + PDQ(0,0,0)),

`K = 2` = ARIMA(log(Turnover) ~ fourier(K=2) + PDQ(0,0,0)),

`K = 3` = ARIMA(log(Turnover) ~ fourier(K=3) + PDQ(0,0,0)),

`K = 4` = ARIMA(log(Turnover) ~ fourier(K=4) + PDQ(0,0,0)),

`K = 5` = ARIMA(log(Turnover) ~ fourier(K=5) + PDQ(0,0,0)),

`K = 6` = ARIMA(log(Turnover) ~ fourier(K=6) + PDQ(0,0,0)),

)

fit |>

forecast(h = "2 years") |>

autoplot(aus_cafe, level = 95) +

facet_wrap(vars(.model), ncol = 2) +

guides(colour = "none", fill = "none", level = "none") +

geom_label(

aes(x = yearmonth("2007 Jan"), y = 4250,

label = paste0("AICc = ", format(AICc))),

data = glance(fit)

) +

labs(title= "Total monthly eating-out expenditure",

y="$ billions")

10.6 Lagged predictors

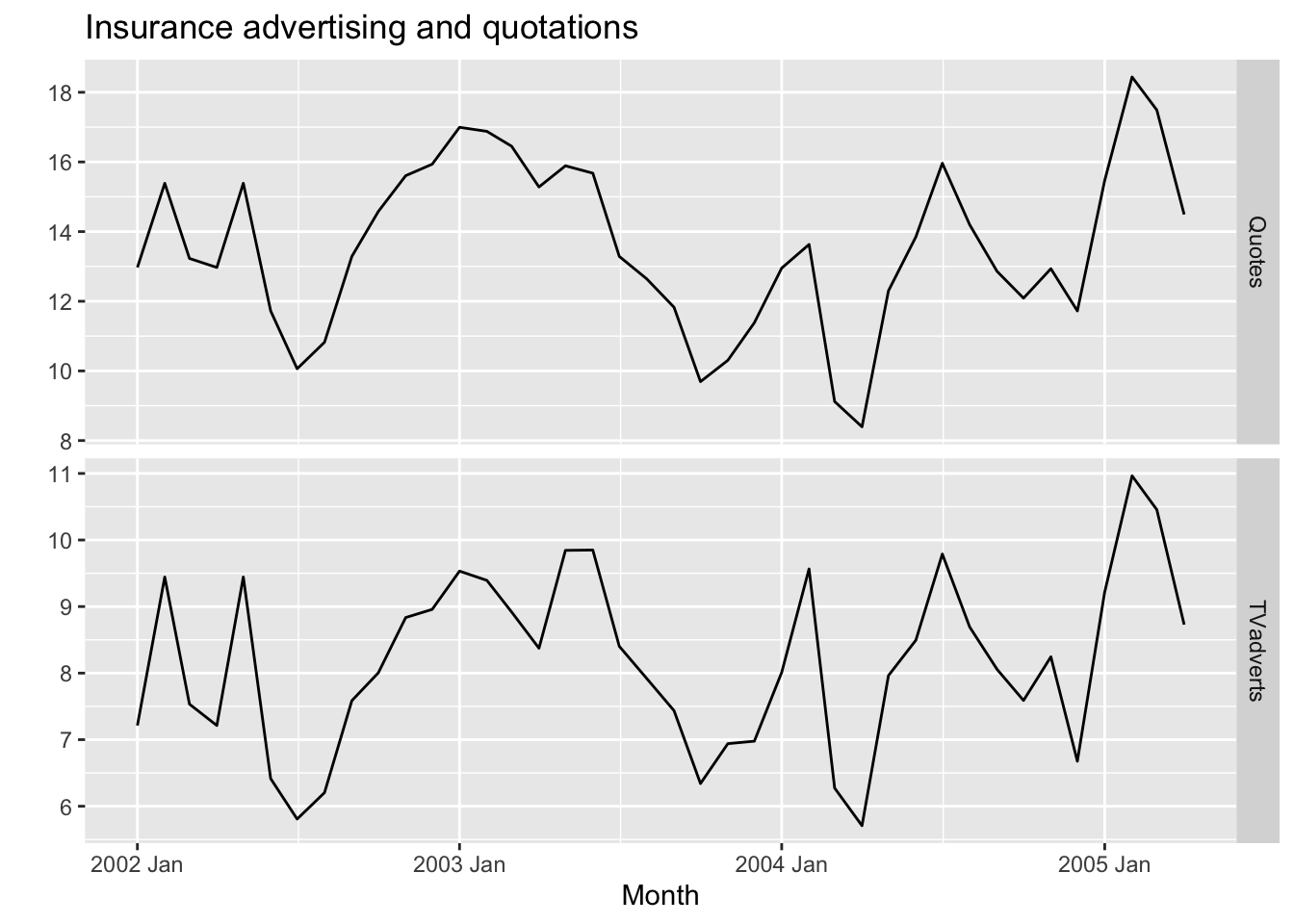

10.6.1 Example: TV advertising and insurance quotations

insurance |>

pivot_longer(Quotes:TVadverts) |>

ggplot(aes(x = Month, y = value)) +

geom_line() +

facet_grid(vars(name), scales = "free_y") +

labs(y = "", title = "Insurance advertising and quotations")

fit <- insurance |>

# Restrict data so models use same fitting period

mutate(Quotes = c(NA, NA, NA, Quotes[4:40])) |>

# Estimate models

model(

lag0 = ARIMA(Quotes ~ pdq(d = 0) + TVadverts),

lag1 = ARIMA(Quotes ~ pdq(d = 0) +

TVadverts + lag(TVadverts)),

lag2 = ARIMA(Quotes ~ pdq(d = 0) +

TVadverts + lag(TVadverts) +

lag(TVadverts, 2)),

lag3 = ARIMA(Quotes ~ pdq(d = 0) +

TVadverts + lag(TVadverts) +

lag(TVadverts, 2) + lag(TVadverts, 3))

)

fit |> glance()## # A tibble: 4 × 8

## .model sigma2 log_lik AIC AICc BIC ar_roots ma_roots

## <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <list> <list>

## 1 lag0 0.265 -28.3 66.6 68.3 75.0 <cpl [2]> <cpl [0]>

## 2 lag1 0.209 -24.0 58.1 59.9 66.5 <cpl [1]> <cpl [1]>

## 3 lag2 0.215 -24.0 60.0 62.6 70.2 <cpl [1]> <cpl [1]>

## 4 lag3 0.206 -22.2 60.3 65.0 73.8 <cpl [1]> <cpl [1]>fit_best <- insurance |>

model(ARIMA(Quotes ~ pdq(d = 0) +

TVadverts + lag(TVadverts)))

report(fit_best)## Series: Quotes

## Model: LM w/ ARIMA(1,0,2) errors

##

## Coefficients:

## ar1 ma1 ma2 TVadverts lag(TVadverts) intercept

## 0.5123 0.9169 0.4591 1.2527 0.1464 2.1554

## s.e. 0.1849 0.2051 0.1895 0.0588 0.0531 0.8595

##

## sigma^2 estimated as 0.2166: log likelihood=-23.94

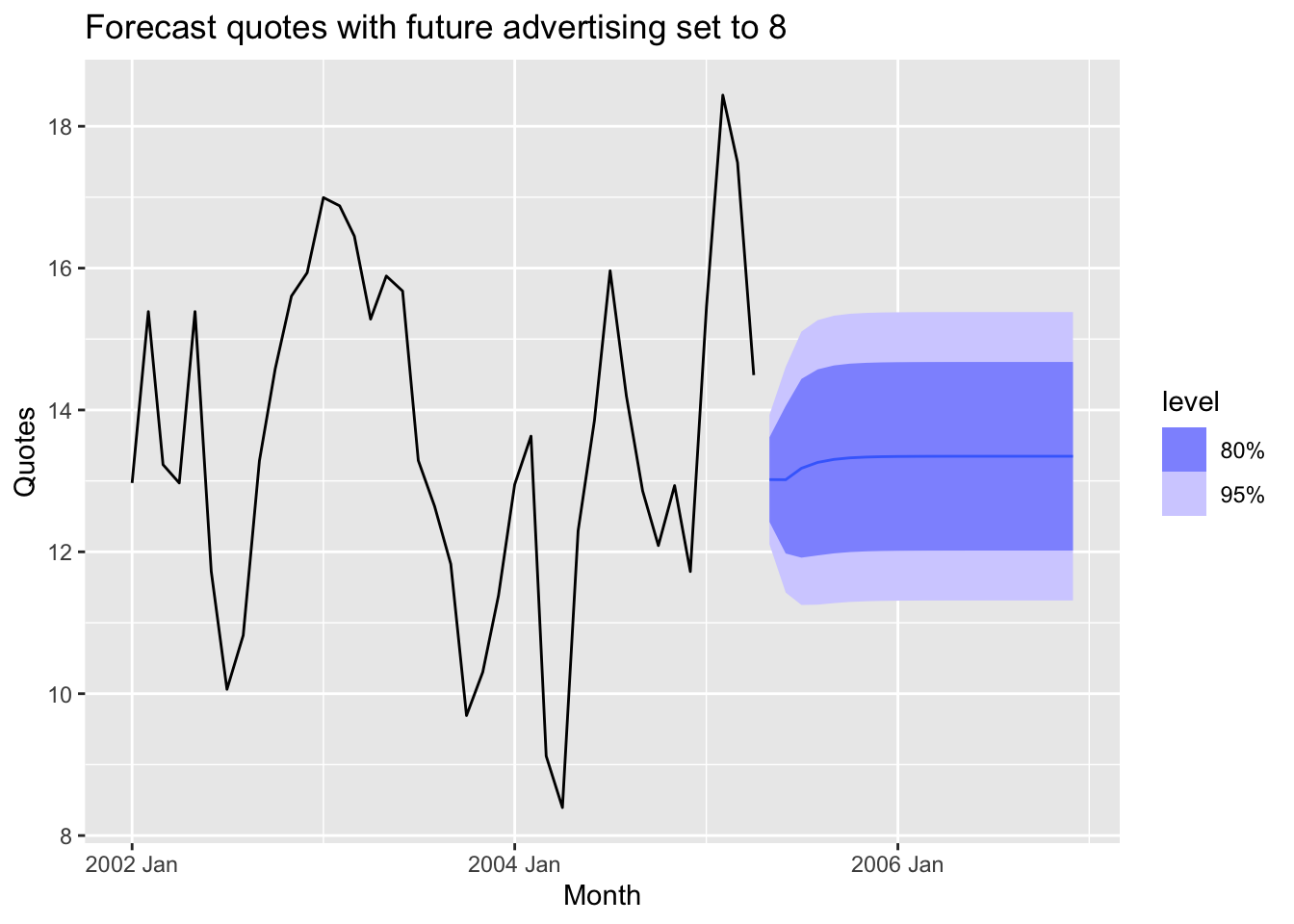

## AIC=61.88 AICc=65.38 BIC=73.7insurance_future <- new_data(insurance, 20) |>

mutate(TVadverts = 8)

fit_best |>

forecast(insurance_future) |>

autoplot(insurance) +

labs(

y = "Quotes",

title = "Forecast quotes with future advertising set to 8"

)